WE HELP COMPANIES BUILD HIGH-PERFORMANCE CULTURES THAT DELIVER SUSTAINED PROFITABLE GROWTH

A Proven Process

Whether you’re in a turnaround situation, a renewal phase with increased expectations, or a period of rapid expansion, there are times when only an enterprise-wide transformation will do. Our proven process has distilled the critical elements companies need to transform their business for good—it’s what we call a high-performance culture, and it’s what enables our clients to deliver results that are profitable, measurable, and sustainable.

IMPACT ON ALL FRONTS

While all successful transformations take time, we understand the need to achieve financial results, fast. Which is why, at the beginning of any transformation, we focus on delivering immediate impact to your bottom line, cash flow, and top-line growth—all while building the cultural and organizational infrastructure it takes to deliver sustained, profitable growth.

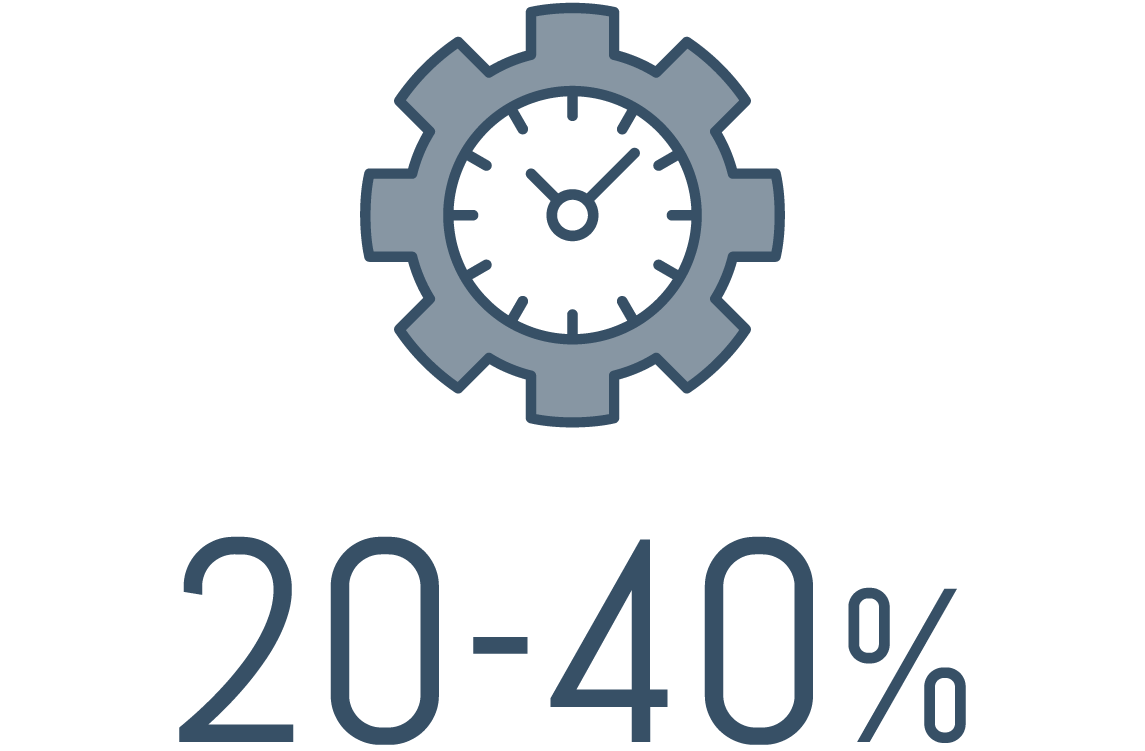

PRODUCTIVITY GAINS

AVERAGE ROI

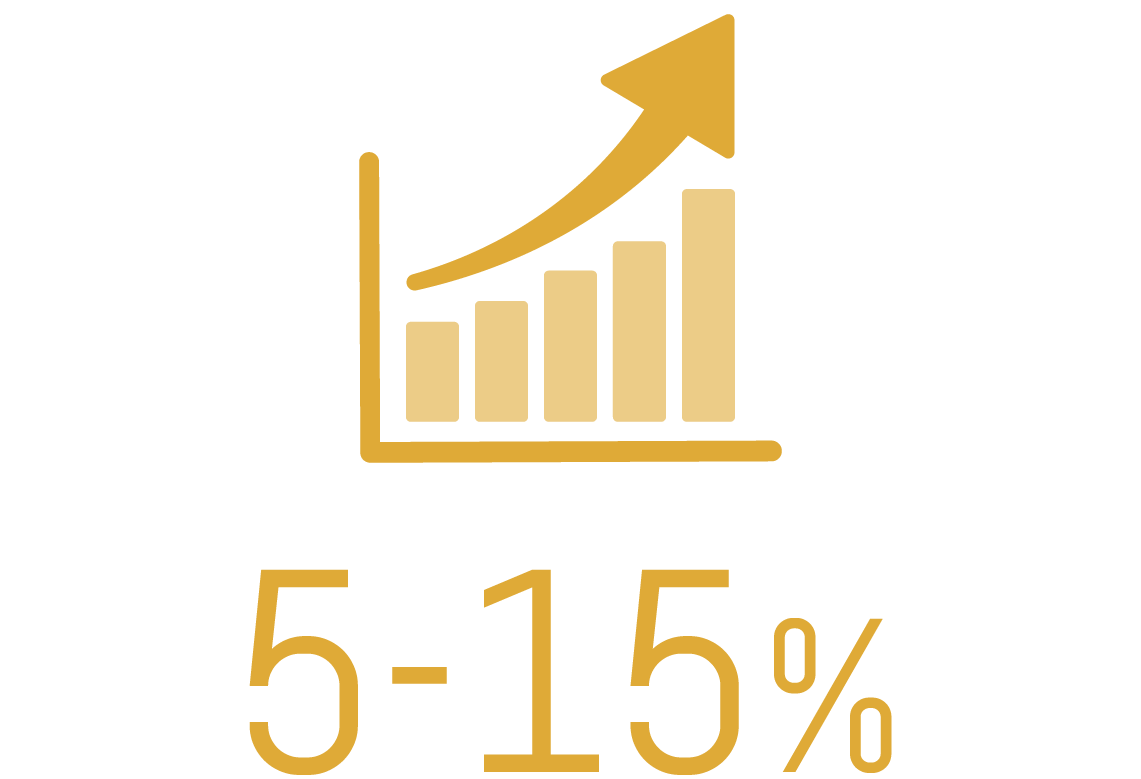

SALES GROWTH

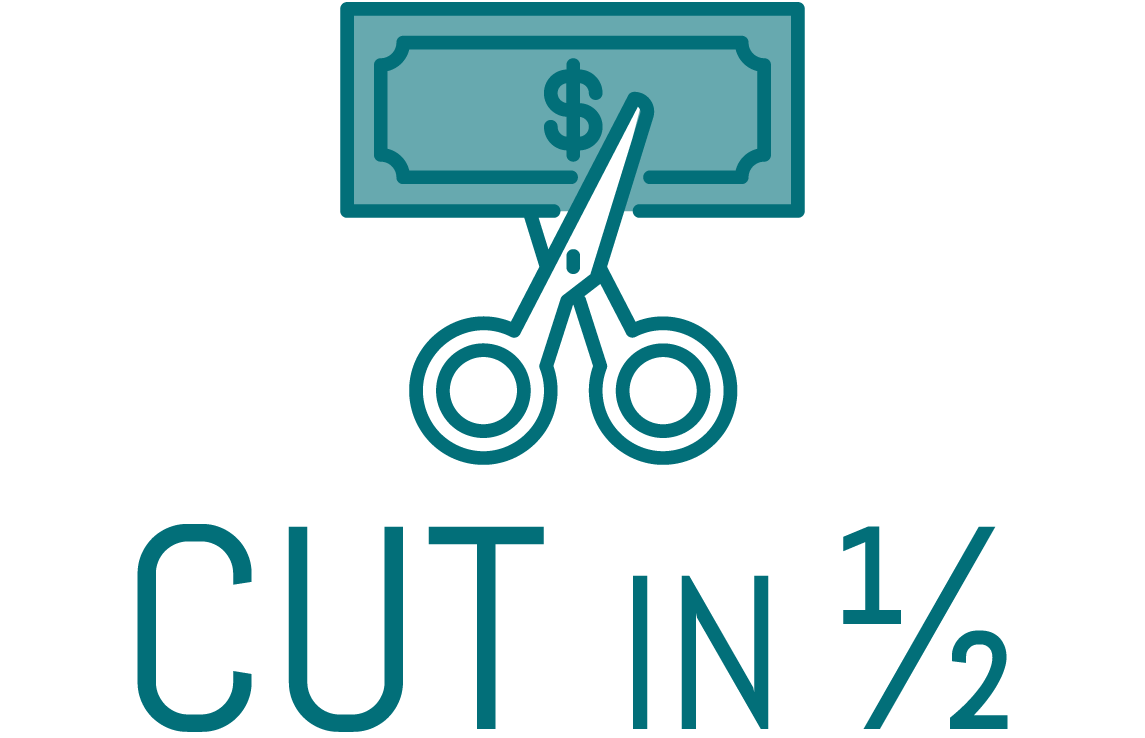

CAPEX SPENDING

BUSINESSES WE’VE HELPED TRANSFORM:

EXTENSIVE EXPERTISE

High-performance cultures are at the core of every successful organization, and the expertise required to build them is extensive. Which is why we’ve filled our ranks with senior-level practitioners who have led successful Lean transformations in just about every industry.

TRUE TRANSFORMATION

Leaders of enterprises big and small have enlisted our proven approach to deliver sustained, profitable growth. But, before those results were realized, many of those leaders felt like they were being held back.

GET STARTED

Whatever challenges your company is facing, we can help. Get in touch, and we’ll help you transform your business for good.